Price Basics

Understanding How Price Works in Stock Markets: Unveiling the Dynamics of Market Movements

In the vast realm of stock markets, price serves as a fundamental aspect that drives trading decisions and market movements. Understanding how price works is crucial for investors and traders alike, as it provides valuable insights into market trends, potential profit opportunities, and risk management strategies. In this comprehensive blog, we will delve into the intricacies of price dynamics in stock markets and shed light on the factors that influence its movements.

- Price as a Reflection of Market Forces:

At its core, price in the stock market represents the equilibrium between supply and demand. It is influenced by a multitude of factors, including economic indicators, company performance, geopolitical events, investor sentiment, and market psychology. The constant interaction of buyers and sellers in the market leads to price fluctuations, creating opportunities for profit or loss. - Price Discovery Mechanism:

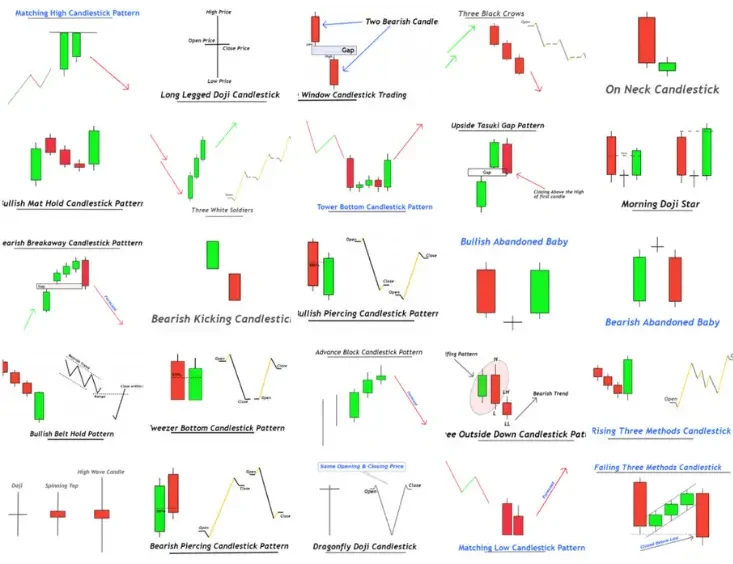

The stock market operates on the principle of price discovery, where buyers and sellers come together to determine the fair value of a security. This process involves the continuous matching of buy and sell orders, resulting in price adjustments based on the prevailing supply and demand dynamics. Through this mechanism, market participants collectively contribute to the formation of market prices. - Technical Analysis and Price Patterns:

Technical analysis plays a significant role in deciphering price movements. Traders utilize various tools and techniques, such as chart patterns, trend lines, moving averages, and oscillators, to identify potential price reversals, breakouts, or trends. These patterns and indicators assist in predicting future price movements based on historical price data. - Fundamental Analysis and Price Drivers:

Fundamental analysis focuses on evaluating the intrinsic value of a stock by assessing relevant financial and non-financial factors. Factors such as company earnings, revenue growth, industry trends, competitive landscape, and macroeconomic indicators influence the perception of a stock’s value, which ultimately impacts its price in the market. - Market Psychology and Price Volatility:

Price movements in stock markets are often influenced by the collective psychology of market participants. Fear, greed, optimism, and pessimism can drive exaggerated price swings and heightened volatility. Understanding investor sentiment and market psychology can provide insights into potential market trends and help manage risk effectively. - Market Efficiency and Price Information:

Efficiency in stock markets implies that prices reflect all available information. The efficient market hypothesis suggests that it is difficult to consistently outperform the market by analyzing past price data or public information. However, proponents of behavioral finance argue that market inefficiencies exist due to psychological biases and informational asymmetry, creating opportunities for skilled traders to profit. - Market Manipulation and Price Distortion:

While stock markets strive for fairness and transparency, instances of market manipulation can occur, leading to distorted prices. Manipulative practices such as insider trading, pump-and-dump schemes, and false rumors can artificially inflate or deflate stock prices. Regulatory bodies and market surveillance play a crucial role in maintaining market integrity and ensuring fair price discovery.

Mastering the dynamics of how price works in stock markets is a continuous learning process for investors and traders. By understanding the underlying forces that drive price movements, analyzing market trends, and incorporating various analytical tools, market participants can make informed decisions and enhance their chances of success. Whether through technical analysis, fundamental analysis, or a combination of both, recognizing the complexities of price dynamics empowers individuals to navigate the stock market with confidence and prudence. Remember, knowledge, discipline, and adaptability are key to thriving in the dynamic world of stock market investing.